Inventory Turnover

Inventory turnover is a ratio that measures the given number of times inventory is sold or consumed in a given time period.

Also known as inventory turns, stock turn, and stock turnover, the inventory turnover formula is calculated by dividing the cost of goods sold (COGS) by average inventory.

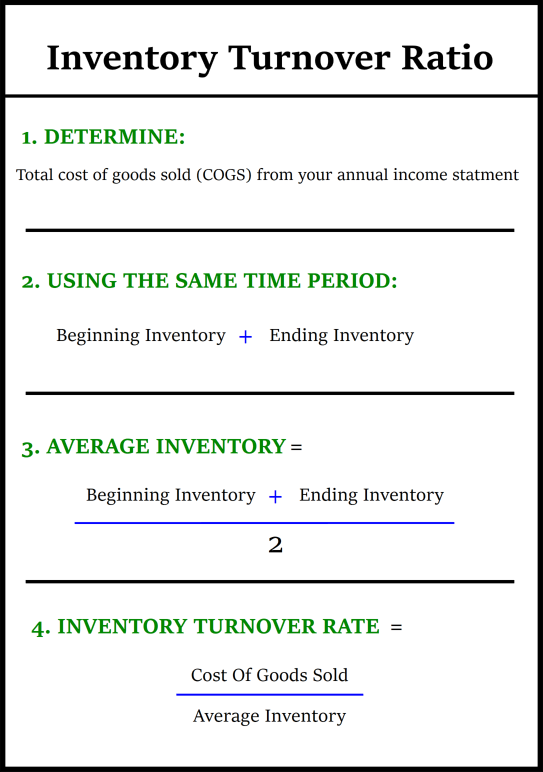

How to Calculate the Inventory Turnover Rate

There's a simple formula to calculate the inventory turnover with ease.

- Determine the total cost of goods sold (cogs) from your annual income statement.

- Calculate the cost of average inventory by adding together the beginning inventory and ending inventory balances for a single month and divide by two.

- Finally, divide the cost of goods sold (cogs) by average inventory.

The inventory turnover ratio is critically important because total turnover depends on two fundamental components of performance.

First is stock purchasing. If large amounts of inventory are purchased during the year, your company will have to sell greater amounts of inventory to improve its turnover. If you can’t sell the inventory, it will incur storage costs and other holding costs.

Second component is sales. Sales have to match inventory purchases otherwise the inventory will not turn effectively. The purchasing and sales departments must be in tune with each other.

Turnover to Measure Performance

An inventory turnover formula can be used to measure the overall efficiency of a business. In general, higher inventory turnover indicates better performance and lower turnover inefficiency.

A high turn shows that your not overspending by buying too much and wasting resources on storage costs. It also shows that you’re effectively selling the inventory you buy and replenishing cash quickly.

Alternatively, a low inventory turnover rate may be caused by overstocking or inefficiencies in the product line or sales and marketing effort. It is usually a bad sign because products tend to deteriorate as they sit in a warehouse while incurring holding costs. Furthermore, excess inventory ties up a company’s cash and makes you vulnerable to drops in market prices.

There’s nuance and exceptions to those general principles. An exceptionally high turnover rate may point to strong sales or ineffective buying, ultimately leading to a loss in business as the inventory is too low. This can result in stock shortages and, eventually, lower sales.

Good rule of thumb:Average Inventory is not to high if inventory rate X gross profit margin (%) is greater than 100%

Increase Profitability

Naturally, an item whose inventory is sold once a year has a higher holding cost than one that turns over more often.

Increasing inventory turnover drives profitability for three reasons:

- Faster turns reduce holding costs: e.g., rent, utilities, insurance, theft, and other costs of maintaining a stock to be sold.

- Reduced holding costs increase net income and profitability as long as the revenue from selling the item remains constant.

- Inventory that turns over quickly also increases your responsiveness to customer demands. This is a major concern in fashion and technology.

Inventory Turnover Optimization

There are many strategies a business can adopt to improve their Inventory Turnover ratio:

- Increase demand for inventory through a targeted, well-designed and cost-appropriate marketing campaign.

- Review the businesses pricing strategy and analyze what will lead to an overall increase in sales value.

- Regularly review purchase prices with suppliers and ask for discounts when requesting a quote or placing orders.

- Define inventory groups in a manner that will be useful to your business so you’re better placed to analyze, understand, and react to inventory that theoretically should behave in a similar manner.

- Get a deep understanding of your best selling products and stock inventory that sells.

- Optimize the supply chain by buying smaller quantities more frequently.

- Improve forecasting accuracy by grouping inventory and monitoring trends.

- Encourage clients to pre-order products, enabling your business to plan inventory purchases.

- Review and eliminate stagnant inventory to prevent it from occupying valuable warehouse space.

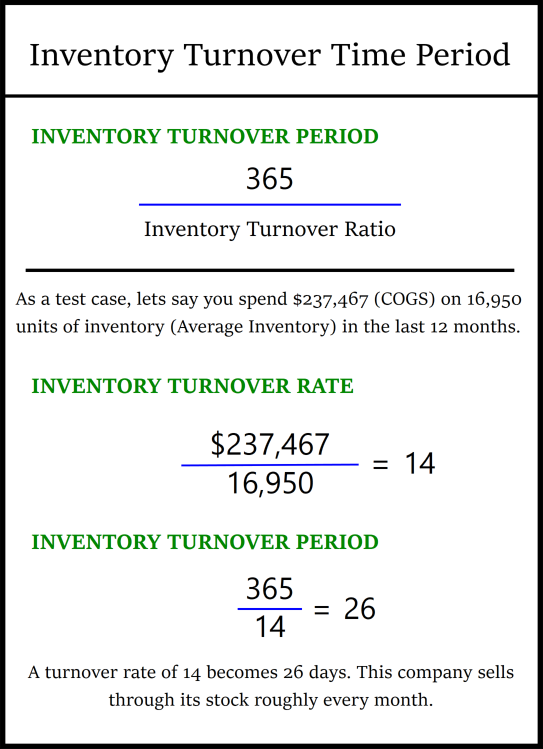

Inventory Turnover Time Period

Once you have the turn rate calculating the number of days it takes to clear your inventory only takes a few seconds. Since there are 365 days in a year, simply divide 365 by your turnover ratio.

The result is the average number of days it takes to sell through inventory.

So, what does this tell you?

Benchmark Your Turnover

A company’s inventory turnover varies greatly by industry. Fashion retailers average between 4 and 6. Automotive components can be as high as 40. Grocery stores are around 14. Car dealerships are often as low as 2 to 3.

In short, low-margin industries tend to have higher inventory turnover ratios than high-margin industries because low-margin industries must offset lower per-unit profits with higher unit-sales volume.

Moreover, it is important to understand that the timing of inventory purchases — particularly those made in preparation for special promotions or new product introductions — can suddenly and somewhat artificially change the ratio.

These Factors Mean Two Things When Benchmarking Your Inventory Turnover:

- When researching, always compare yourself to brands within your vertical and at your price point.

- Better still, benchmark your business’ past performance and set future goals from there.

Updated 4 months ago