Fixing Inventory Shrinkage Problems

A tactical guide for getting out of shrink panic. You got this!

Seeing something wild on your P&L or in your Inventory Shrink account?

Have no fear this guide will help you through to the other side of inventory shrinkage woes!

The first thing to know is that scary inventory shrinkage with QuickBooks online is always caused by one of following reasons:

- Timeliness of inventory transaction reporting between DataNinja and QuickBooks (not keeping DataNinja tidy)

- Incorrect costing data (a bad unit cost definition happened somewhere)

- Business practices that are bad for how QuickBooks Online is built to properly account for inventory value.

- Using posting transactions at the wrong time for inventory items

- Driving Inventory Negative

You COULD mask the problem with an impromptu journal entry… but don’t be THAT accountant. Getting this fixed properly will setup the business for accurate inventory-related financials.

Step 1: Physical Inventory Review

How much confidence do you have that the inventory quantities in DataNinja for each item are accurate? Review where things may be off. Perhaps a few quick location cycle counts, will get things closer to 100%.

Step 2: Reconcile Inventory Between DataNinja and QuickBooks

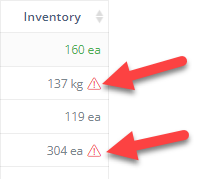

Ideally, you should have ZERO items in your DataNinja parts list that have a quantity alert. If you do have these triangles:

Follow the reconcile inventory guide to get rid of them.

Step 3: QuickBooks Inventory Valuation Summary Report

Run the inventory valuation summary report in QuickBooks Online and verify each of the following:

- Ensure ALL unit costs are as expected. (Flag and correct any that are not, both in DataNinja and QuickBooks Online)

- Ensure all Quantities are as expected. (Flag and correct any that are not, both in DataNinja and QuickBooks Online)

- Review any zero quantities with value or positive quantities with a negative value. Fix any scenarios where inventory went negative for any item.

Driving inventory Negative Disrupts QuickBooks Inventory Valuation Cost Tiers.When adjusting UP from below zero OR when an adjustment will result in item inventory quantity below zero there is NOT a FIFO cost tier for QuickBooks to use. Instead it will use the cost “LAST” used for the item. If unavailable it will use the item starting unit cost, if there has never been any inventory then it will fall back to the standard cost.

Step 4: Inventory Asset Accounts Check

In QuickBooks, review each inventory items assigned asset account correct any assignments that are not as expected.

1.In QuickBooks, navigate to the products and services list ( Sales >> Products and Services)

- Export the list to excel, and inspect the Inventory Asset account associated with each inventory item. (Column M)

3. If any inventory items are associated with the wrong asset account, correct in QuickBooks by clicking Edit on the Products and Services list.

Step 5: Verify Inventory Valuation Matches Inventory Assets on Balance Sheet.

With a cleaned up Inventory Valuation report and with your inventory items in the proper accounts do an analysis to reconcile your inventory valuation report to your balance sheet (for each of your inventory asset accounts if you use more than one).

If QuickBooks inventory valuation has matched balance sheet inventory assets ever before with DataNinja connected, steps one through four above should produce a match again.

If this is your FIRST TIME dealing with QuickBooks Shrinkage, then a single Journal Entry per inventory asset account may be required to compensate for inventory inaccuracy between pre-DataNinja go-live, and your first physical inventory barcoding with DataNinja.

Why do a Journal Entry in Step 5 if this is my first time?Before DataNinja, inventory counts from the warehouse were periodically used to inform QuickBooks inventory on the balance sheet. These inventory counts were never 100% accurate. After DataNinja barcoding was implemented, the system began communicating live inventory levels with QuickBooks. The difference between the old way (spreadsheet counts informing QuickBooks) and the new way (live barcode scans syncing with QuickBooks) will produce a variance.

Your warehouse in actuality will have more or less inventory than what was thought previously. This delta should be corrected with a Journal Entry ONCE AND ONLY ONCE on your First time following these steps.

Updated 4 months ago